Typically, both you and the payer should receive a copy of the sales receipt to document the transaction.īusy doing a lot of tracking? Hourly can take time and attendance tracking off your hands-and use that data to update your payroll in real-time.

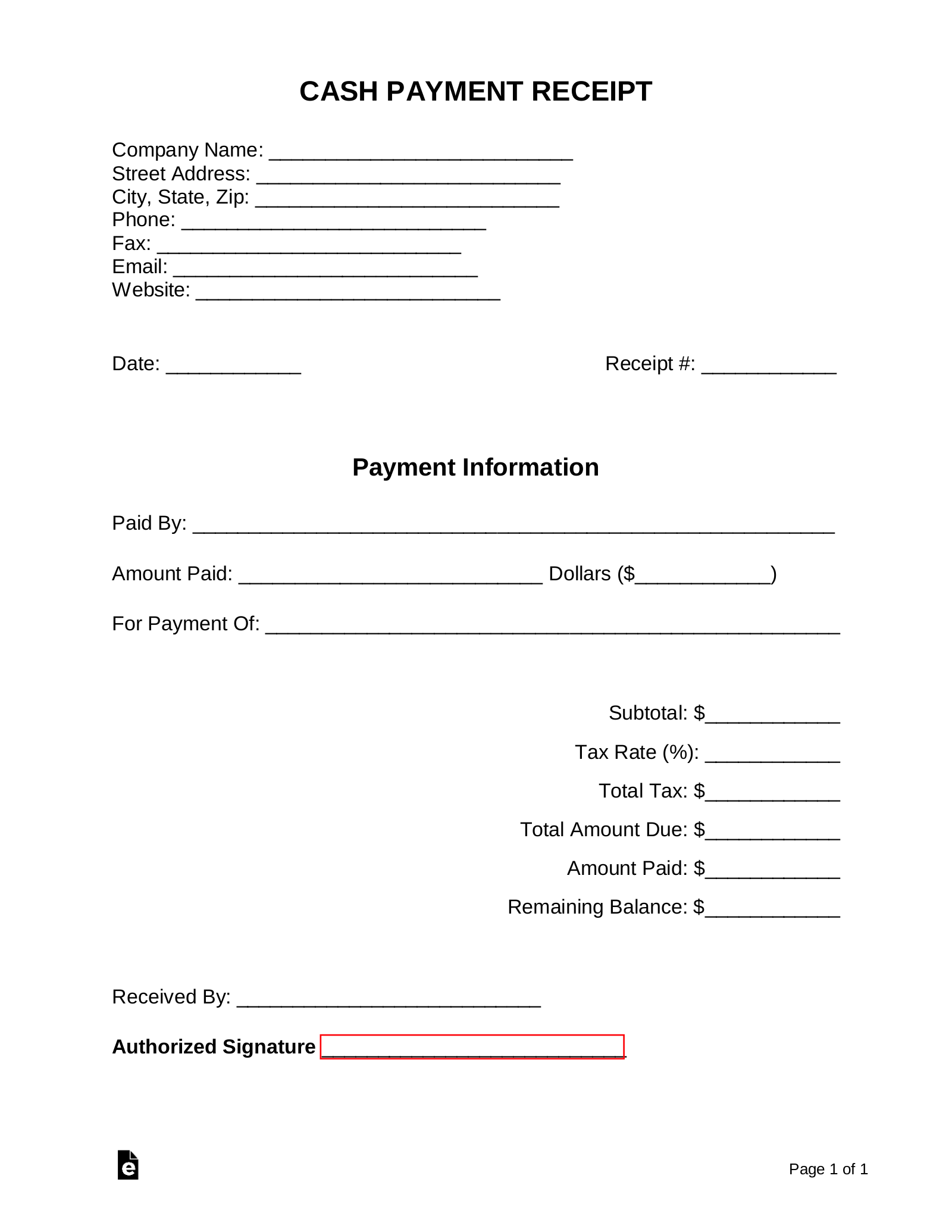

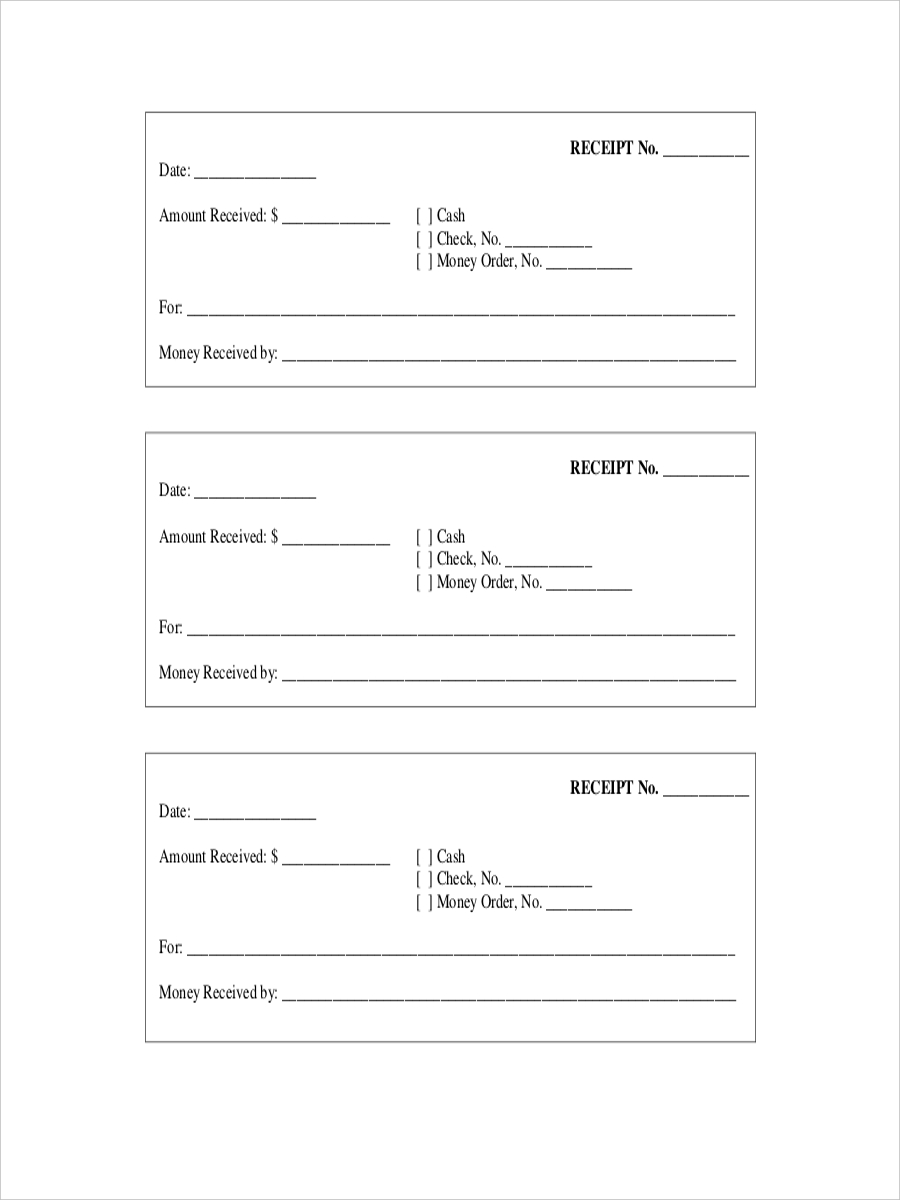

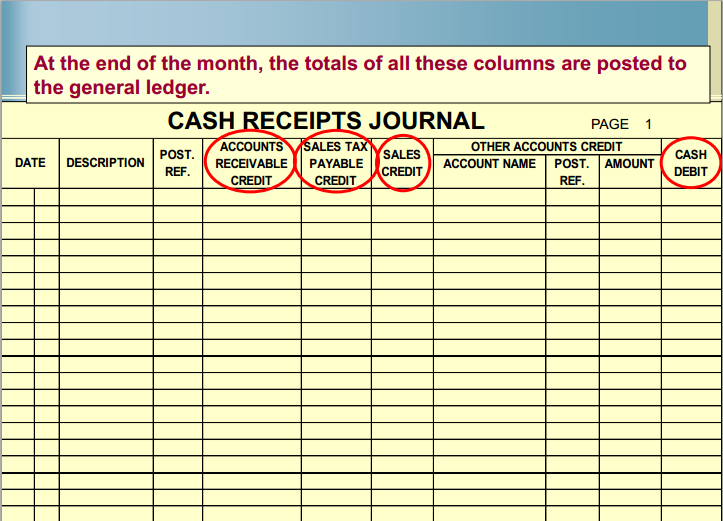

Decreases your accounts receivable account (i.e., the amount of cash your business is owed).Increases your cash account (i.e., your current assets reported on your balance sheet).In other words, you need to create and record a cash receipt any time a transaction: When Do You Record a Receipt?īusinesses need to generate receipts whenever they receive cash (via physical or electronic means, such as cash, check, or payment card) from any source, including clients, customers, lenders, and investors. Some receipts might also include other information-for example, the business name and address, contact information, the specific cash register or POS system used during a transaction, a unique number to identify the receipt, a check number, the name of the client or customer, and/or a customer signature. The payment method (for example, bank deposit, cash, debit or credit card, personal check or cashier check, store credit).These financial statements can be physical or digital and feature a variety of details, including:

But as a small business owner, throwing receipts away is not an option-because cash receipts play an important role in a variety of business functions, including accounting, planning, and tax purposes.īut what, exactly, are these types of receipts? And why are they important for your business? What Are Cash Receipts?Ī cash receipt is a record that proves your business made a cash sale. These receipts-which might be printed on paper or sent digitally via email or an app-record the key details of the transaction, including what you purchased, how you paid, and the amount of money you spent.Īs a consumer, you probably don’t think too much about that receipt in fact, you may just throw it right in the trash. When you buy something, you’re usually given a receipt documenting that purchase.

0 kommentar(er)

0 kommentar(er)